If you’re unfortunate to have been involved in a car accident, you need to know how to correctly, fairly and legally resolve the situation with all those involved. Understanding how to properly deal with insurance and the emergency services, if they’ve been contacted, can also be crucial to knowing if you’re ever involved in a car accident.

This guide from Stoneacre Accident Aftercare provides information on what to do after a car accident, how to correctly pursue insurance claims, how to arrange repairs for an accident-damaged vehicle, and how to properly deal with the police and insurance companies following a crash.

Have you been involved in a car accident?

If you have been involved in a car accident, our Accident Aftercare team are here to help with their extensive experience managing car accidents. Contact the team immediately to discuss how we can help you with the following:

- car repairs

- approved repairs for the world’s leading manufacturers

- roadside recovery & temporary vehicle storage

- courtesy car or like-for-like replacement vehicle

- claim management for fault and non-fault accidents

- £250 towards your insurance excess

Sections in this guide

- What to do when you get in a car accident?

- Dealing with insurance companies after an accident

- Dealing with the police after an accident

- Repairing your vehicle after an accident

- Recovering from a road accident

- Other FAQs

What to do when you get in a car accident?

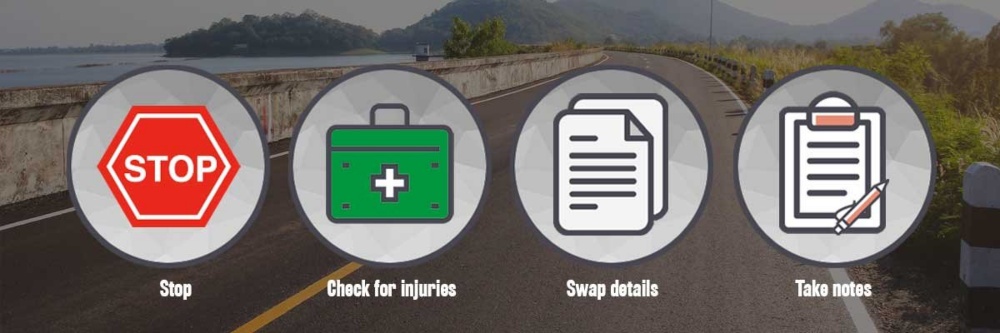

A step by step process for what to do after a car accident:

- Stop the car or find a safe refuge area nearby

- You are required by law (section 170 of Road Traffic Act 1988) to stop your vehicle at the scene of an accident. If it is not safe to stop your car immediately, you should find the nearest refuge area to pull into and stop. This could be a motorway hard shoulder or a side street away from a busy main road.

- Check for injuries and call an ambulance if required

- Depending on the severity of the accident, someone may be injured as a result of the crash. Check for injuries on yourself first and then on your passengers, as well as on any other individuals involved including pedestrian bystanders. Call an ambulance if required.

- Assess the situation and call the emergency services if required

- Emergency services will need to be called in the event that a car is on fire or if passengers are injured or trapped inside a vehicle, or a road block has been caused by the accident. If you don’t require an emergency response, call 101.

- Exchange details with individuals involved

- You are required by law to exchange details with the drivers of the vehicles involved, including the names and addresses of both the driver and the vehicle owner (unless they are one and the same). Failure to do so is an offence. This information is also required by your insurance company to process any claims. Exchange driving license information (take a photo) for contact details and make a note of car identification marks (registration plate, make & model) for all vehicles involved.

- Gather information on the incident

- Insurance companies use information about the scene of the accident to determine fault and liability. You should always try to gather as much information as you can about the scene of the accident. Take photographs of where the crash happened and the damage to the vehicles involved. Take detailed notes on important information too: time of the day, the weather, traffic conditions, driving conditions. All this information can be useful for insurers and the Police. Also exchange contact details with any bystanders or witnesses who can support your story of what happened. Making a thorough note of all individuals and vehicles involved will allow you to produce a strong recollection of the accident.

- Contact your insurance company

- You should contact your insurer as soon as possible to provide all the details that you gathered at the scene of the accident. If you wish to proceed with a claim your insurance company will proceed to contact all other individuals involved to assess fault and liability and resolve all claims. Once your insurance company has been informed of the accident, you can then proceed to arrange car repairs. Learn more about repairing your vehicle after an accident.

What to do after a minor car accident?

A minor car accident typically means a slow-moving impact that has seemingly caused minimum damage or injury to any vehicle or person involved. Regardless of what you perceive the severity of the accident to be, you must always follow the above accident checklist through steps 1 to 6. This includes exchanging contact details with those involved and informing your insurer about the incident. Even what you’d suspect is only a minor accident can still cause vehicle damage and personal injury that may not be apparent at the time.

What to do if someone hits your car and drives off?

If you have an accident with someone and they drive away from the scene, you must still follow all the recommended steps mentioned above. Stop the car or find a safe refuge, check for injuries or casualties from the crash and call the necessary emergency services.

To report the hit and run you should then proceed to call the police to report the incident. You’ll receive a crime number to follow up with. You can then continue to follow step 5 and gather details and information from the scene, including eye witness accounts, which can be provided to the police. As soon as it is safe and practical to do so, you should then inform your insurance company about the incident.

What to do after a car accident that is not your fault?

Our step by step process should be followed in all incidents where you think you are not at fault for the accident. Try to gather as much information about the scene of the incident as you can and ensure you exchange all the necessary information with all parties involved. If you suspect a crime has been committed you should contact the police.

What to do after a car accident that is your fault?

Our step by step process should be followed in all incidents where you think you are at fault for the accident. It’s advised that you don’t admit guilt at the scene of the accident, which includes avoiding apologising as this can be seen as an admission of guilt in insurance proceedings. Simply follow due process and exchange all the relevant details and leave the issue of liability and fault to be decided by the insurance company.

If you are immediately blamed for an accident and dispute this, simply continue to gather as much information about the scene as you can and cooperate fairly, respectfully and legally with those involved. Even if you do suspect yourself at fault there may have been a mistake made by another vehicle involved that you might not have noticed at the time and that an eye witness may account for.

What to do if you’re injured in a car accident?

If you’re injured in a car accident, your first priority must be getting to a safe place where you can stop your vehicle. You then need to assess your injuries and call an ambulance if you need urgent medical attention. Prioritise yourself and your own health and wellbeing before concerning yourself with anything else.

Dealing with insurance companies after an accident

All car accidents should be reported to your insurance company, regardless of how small or insignificant you think one is. Insurance premiums are calculated on the availability of information about your driving history, so incomplete information may invalidate your insurance policy. This is why it is often a stipulation of contracts that you must inform your insurer about all car accidents, regardless of how minor you think they are and even if you don’t want to make a claim.

What information does your insurer need about an accident?

All the details that you have exchanged at the scene of the accident (step 4) will be required by your insurance company. Names, addresses and vehicle registrations will allow the insurance company to trace and contact the individuals involved and their respective insurers.

If any claims need to be made, you can then proceed to provide all the additional information you’ve collected at the scene (step 5). Claim handlers for all parties involved will attempt to build up a picture of the incident using information and resources provided to them from the incident, such as photographs, eye witness accounts and CCTV or other digital recordings like from a dashcam. This will allow the insurers to best determine liability. In the event that liability is disputed, the strength of evidence can be a factor in helping you make a claim sway in your favour.

Eye witness accounts are not always used by insurance companies and insurers will always assess the credibility of the statement. Nevertheless, providing contact details for an eye witness can help your claim, especially in disputed cases. If you have contacted the police to inform them of the accident, or to report a crime, your insurer will likely request the police report of the accident or the case file information. They may ask you to provide this information or contact the police directly.

When should you contact your insurer after an accident?

You should contact your insurer to inform them that you’ve been involved in a car accident immediately or as soon as it is safe and practical to do so. Your insurance policy may stipulate a certain time period that you must inform your insurer about a car accident and failure to comply with this may invalidate your cover. So check your insurance documents for this information.

Reporting an accident is also important because even a minor accident can cause damage that may not be immediately noticeable. Car repair costs can quickly add up and the majority of damage isn’t likely to be visible if the engine or chassis is damaged. If you fail to report an incident to your insurer, and later discover your car is damaged and needs to be repaired, if you’ve exceeded the time limit on reporting an accident your insurer may refuse to process any claims and other parties involved may deny the incident even happened if considerable time has passed.

Dealing with accidents: Fault vs non-fault

‘All car accidents that you are involved in should be reported to your insurance company regardless of fault or liability. In the event that you make a claim and all payments have been recovered by your insurance company, this is dealt with as a ‘non-fault claim’. If your insurer has had to cover any funds themselves, this will be deemed as an ‘at-fault claim’ regardless of fault or liability.

Fault claims can often be frustrating if you feel you were not at fault for the accident or if the incident was unavoidable through no fault of your own – like a hit and run. In all circumstances this only makes gathering evidence and information at the scene of an accident the more important so you can best prove you’re not at fault.

If you are at fault for the accident, you should must follow the law and provide all the required information to any person(s) involved. Importantly, you should never admit fault at the scene of an accident or accept blame. Saying ‘sorry’ can be seen as an admission of guilt, so even if it is against your best instincts it’s advised to avoid apologising in any capacity.

Your insurance company will use all the information provided to then determine fault and liability. Simply follow your legal obligations at the scene of the accident, as well as following our accident checklist process on how to gather information and deal with all those involved at the scene. What you do after a car accident shouldn’t be affected by who’s at fault. The insurance companies of those involved will ultimately have the final verdict when it comes to processing claims and paying out.

Insurance claims following a hit and run

If a vehicle hits your car and proceeds to drive off without stopping or exchanging details, it’s important that you follow all the recommended steps and avoid attempting to drive after the vehicle. You should remain at the scene of the accident and contact the police immediately. Their accident report and your crime number can be used for insurance claims.

Unfortunately, if the driver who hit you is unable to be traced, it may result in an at-fault claim if you make a claim and your insurer can’t recover the costs. However, if they can be traced and identified, and the evidence is strong against them, you should be able to make a non-fault claim against them.

How long do you have to report a car accident to your insurance company?

There will be a stipulation within your insurance policy that states a specific time period for reporting accidents to your insurer. This will likely differ between policies as well as between car insurance providers. You should check the terms and conditions of your insurance policy for this information but you should always report a car accident as immediately or as soon as is practical to do so. While there are no legal requirements to report an accident to your insurer, it may affect your ability to make subsequent claims.

How long after a car accident can you claim on your insurance?

If your car is damaged after an accident and you need to make a claim on your insurance to repair it, you can ultimately choose when you wish to make a claim. For a non-fault accident you can use a third-party insurer to cover the costs of your car repairs so there’s no expense to repairing your car immediately.

Following an at-fault accident you may be hesitant to make a claim, especially if the damage is only minor and making a claim would affect your no claims discount. If you don’t choose to repair your car immediately following the crash, you can choose to repair your car through your insurance company at any time thereafter if you’re still covered by the same policy.

Dealing with the police after an accident

In certain circumstances, the Police may need to be contacted. But when should you contact the police after an accident?

You should contact the Police if any of the following occur as the result of a car accident:

- injury or damage to any individuals – other than to the driver of the vehicle at fault

- injury or damage to an animal – other than to any animal being carried in the vehicle at fault

- damage to a vehicle – other than to the vehicle at fault

- damage to property

- a driver withholds information required by law – name, address, insurance certificate

Of course there are other situations in which you should call the Police. Examples include receiving verbal or physical abuse; suspicion of a driver to be under the influence of drugs or alcohol; an individual has fled the scene of the accident or has refused to produce insurance or personal details on demand. If an accident has caused a road block and traffic is queuing up around the scene, the police will also need to be contacted to manage the situation.

You can contact the Police in two capacities. If it is an emergency situation you should call 999 as soon as possible. To report an incident or provide information about a suspected offence that is a non-emergency, call 101. All suspected offences should be reported to the police as soon as possible and within 24 hours. When reporting any of the above offences to the police, you will be required to attend a police station.

What information do you need to record for the police about a car accident?

The Police will only move to prosecute a suspect when they deem there is enough evidence available to secure a conviction. In the unfortunate event that you are the victim of an offence following a road accident, you should aim to record as much information as possible that can be used as evidence. Personal details of the individual involved will help the Police, but if these are withheld you should record information that can help identify the individual – age, gender, skin colour, build, height etc.

You should also record the details of the vehicle, including the registration plate and the make, model and colour. In any case, you should aim to find evidence from by-standers who may have witnessed the incident or locate possible CCTV cameras that may have recordings. Incomplete information of the incident may mean the Police are unable to take their enquiry any further.

How to get CCTV footage from a car accident

CCTV footage and other video recordings can prove helpful when filing car insurance claims. Dashcams are becoming increasingly popular as a way to help settle insurance claims. Research from Aviva found that 1 in 5 drivers currently use a dashcam in their car.

If you require footage from a private CCTV camera, either from one installed on a domestic property or located on commercial or public premises, you can simply contact the owner of the property to request the footage or submit a subject access request (SAR) in writing. SAR is a request for personal data under the Data Protection Act 1998 and can be made in the event of a car accident. Learn more about requesting CCTV footage.

As is the nature of many CCTV cameras, footage may only be temporarily stored on a memory card so act quickly if you wish to attain footage of an accident. It’s advised that you scope out any possible CCTV cameras located at the scene of the incident that you may suspect has recorded the incident and contact the owner either directly or with a SAR request.

Repairing your vehicle after an accident

Having to repair your vehicle after a road accident can be timely and costly, never mind frustrating. You have a few options to repair your car after a crash and ultimately it is your own decision how you wish to repair your vehicle and who you want to do it.

How insurance companies manage car repairs

Insurance companies will always try to encourage that you use their ‘approved repairers’ if you are making a claim for car repairs. An approved repairer is typically a garage that is in partnership with the insurance company in order to manage repairs for their customers. Using an approved repairer is a convenient way for insurance companies to easily oversee the repairs of vehicles and quickly process claims, although it may not always be in the best interest of the policy holder.

Your options for repairing your car after a road accident

When it comes to repairing your vehicle after an accident, you have the legal right to choose who repairs your car. Legislation introduced in 2010 deemed it unfair that insurance companies could dictate to customers who should repair their car. Since then, insurers are not able to force you to use their approved repairers and must still pay-out if you choose your own repairer. Your insurer is still likely to encourage you towards using their approved services, but you don’t have to agree to their recommendations.

Choosing your own repairer gives you a much wider choice of garages and you have much more control over who repairs your vehicle. Your insurance company cannot deny you this right and they are not able to refuse a pay-out if you repair your car through a non-approved repairer. Approved repairers typically work in the best interests of the insurance company and may be pressurised to repair your vehicle quickly and cheaply, using non-original parts that could invalidate your warranty.

Once you’ve received an estimation or a quote from the garage, your insurer will first need to authorise the work. If work is carried out on your car that isn’t approved by your insurer, you may be refused a pay-out. In the case that your vehicle is severely damaged your insurer may simply write-off your vehicle and pay you the market value. This is where GAP insurance from Stoneacre can come in handy to keep you covered if your car is written off.

Tips on finding a reliable accident repair garage

Choosing your own car repairer can be overwhelming. There’s lots of availability out there, from local garages to national companies. But how can you determine a garage that will do a quality repair on your car?

What should you be looking for when choosing a garage for accident repairs?

- Fair and transparent pricing

- Manufacturer-approved repairer if your car is under warranty

- Use OE (original equipment) specification parts

- Guaranteed repairs back to pre-accident condition

- A courtesy car is provided

- Valid guarantee offered on all repairs

- Positive customer experience reviews

Firstly, fair and transparent pricing is important when handling insurance claims. You need to be able to trust that the quoted price provided by the repairer is honoured and that there are not additional fees charged or any extra work undertaken that wasn’t agreed upon. This can cause complications for your claim insofar that your insurer refuses to pay for the unquoted fees. If repairs are overcharged or are expensive, your insurer may also not pay-out in full, especially if they argue that they could have done the repairs cheaper through their approved garages.

It is also paramount that your chosen repairer is able to provide quality repairs for your car. This includes using OE specification parts, which means that parts are made to manufacturer specifications that fit to the make and model of your car. Using non-approved parts can compromise the safety of your for and could potentially cause breakdowns in the future. It can also invalidate your manufacturer warranty. The parts and practices a garage uses should be well advertised and we recommend that you enquire about this with any garage that you receive a quote from.

About Manufacturer-approved Repairers

If your vehicle is under any form of manufacturer warranty, you are likely to require a manufacturer-approved repair service in order to maintain the validity of the warranty. A ‘manufacturer-approved repairer’ will be a garage that has been approved by a car manufacturer to repair their vehicles to meet factory standards. This is typically achieved once the manufacturer has reviewed the equipment at the garage, provided training on how to fix their cars, and supplied parts.

Stipulations of choosing your own repairer

Choosing your own repairer can come with a few caveats. Your insurer may increase the excess on your policy, refuse you access to services like a courtesy car while yours is being repaired, and they may only partially pay-out for the final bill if they deem the cost of the repair to be expensive.

In fact, Defaqto found that only 6% of 363 insurance companies surveyed would provide a courtesy car if the customer chose their own repairer. With this in mind you may wish to find a repairer that provides their own courtesy vehicles to customers. You may also lose the insurance company’s guarantee on car repairs so its imperative that your chosen repairer offers a warranty on all repairs and labour they provide so you’re protected.

Stoneacre Accident Aftercare offer a lifetime guarantee on all car repairs (Ts & Cs apply) so you can have complete assurance when repairing your car through us that you’ll be covered for future manufacturer and labour faults. We will also contribute up to £250 towards your insurance excess, as well as provide a courtesy car or a comparable replacement vehicle* (*only for non-fault claims). This means you will not have to worry about your insurer increasing your excess, or refusing access to a replacement vehicle, if you choose Stoneacre as your repairer.

Managing insurance claims for car repairs

If you’re not at fault for the accident, you will be able to make a non-fault claim as long as your insurer is able to recover the cost from the third party. In these cases, you will not have to claim on your insurance and your no-claims bonus will be protected.

If you are deemed at fault for the accident, you will not be able to claim on a third-party insurance and will need to claim on your own insurance. The same process applies for at-fault claims as it does for non-fault claims. You still have the right to choose who repairs your vehicle and the same fair process still applies on the insurance company’s behalf.

At Stoneacre we can handle car repairs for both fault and non-fault claims. If you have been involved in a car accident we can provide a free and honest estimation or a competitive quote on repairs so you know how much it may cost to repair your vehicle. For non-fault claims, we can also provide a comparable replacement vehicle while yours is off the road and we’ll contribute up to £250 towards your insurance excess.

For all accident repairs, we’ll always liaise with your insurer on your behalf to authorise all necessary repairs. This will help you make a successful claim and avoid suffering any surprise stipulations of your insurance policy. We’ll always provide a fair and honest estimation so the cost of your repair is completely transparent to you and your insurer.

Recovering from a road accident

How to lower your insurance premiums after making a claim

Regardless of whether you were at fault for the accident, making a claim on your insurer will likely always lead to increasing your car insurance premiums. A claim is simply classed as any situation where your insurer can’t recover the cost of car repairs or personal injury from a third-party.

A claim will affect your no claims discount, resulting in a likely increase of your insurances premiums. But how can you lower your insurance after an accident?

- Increase your voluntary excess

- Purchase a car in a lower insurance group

- Purchase a telematics insurance policy (black-box)

- Find a more secure location to keep your vehicle

- Protect your no claims discount

- Improve credit score

Unfortunately, there aren’t many quick fixes for rising insurance premiums after a car accident. Increasing your excess and driving a car in a lower insurance group can help you save money, but rebuilding your no claims bonus will help reduce your premiums in the years following an accident. You can also choose to protect your no claims discount in case you need to make any future claims.

How long does a car accident stay on your insurance record?

Accidents on your insurance record are not permanent. When taking out an insurance policy, many insurers only ask for 3 to 5 years’ worth of driving records, so you’ll only be required to provide information about historical accidents and claims as long as they fall into the time period that your insurer requires to know about. Therefore, while a previous accident may still remain on your driving record, after 5+ years it is unlikely to affect your insurance premiums.

Accident FAQs

If you are witness to a car accident in the UK you must always stop and remain at the scene of the accident. Whether you are a witness from another vehicle or as a pedestrian or cyclist bystanders, you must cooperate as an eye witness. First and foremost make sure that those involved are OK and are not injured. Call the emergency services if they are needed.

You may also be asked to provide your name, address and contact details to act as a witness by one of the parties involved. You may also be asked to give a statement to the police to aid their investigation as a witness.

You can check for free if any vehicle has been involved in a car accident in the UK. Unfortunately, such checks do not 100% guarantee the car hasn’t been involved in a crash as previous drivers may not have declared accidents they’ve been involved in to their insurer.

If you’re buying from an established automotive dealer they will likely run background checks on the vehicle to ensure it hasn’t been in an accident or written off. They run these checks when they are both selling vehicles and accepting part exchanges. On sites like Autotrader you make see some cars listed with category letters (i.e CAT N, CAT S), which means they’ve been written off by an insurer with varying degrees of damage.

Insurance for a courtesy car is typically provided by the company providing the vehicle or your insurance company may provide cover for driving a replacement vehicle in your policy. If you crash a courtesy car, you’re likely to be covered in the same way as any other vehicle you drive, which means if the crash is your fault you’ll be required to pay the excess and if you’re not at fault you’ll be able to claim on a third-party insurance.

Car repair times vary depending on the state of the vehicle. The availability of parts, vehicle transportation and the specialism of the repair can all length repair times. Once your vehicle has been assessed, your repairer should be able to accurately predict how long it will take to be repaired.

*Please note that the information presented on this page is to be used at your own risk. We cannot accept liability for any decision you take as a result of reading information that is provided on this page. We encourage you to always carry out your own research to find information that may be applicable to your own personal situation and to always refer to the Police, Fire or Ambulance services in emergency situations, or to your own insurance company regarding any insurance-based queries. The information presented here is not to be used as legal or financial advice.