When deciding on how to purchase a car, you’ll find several options available – from buying outright to getting a motor loan. However, car finance, particularly Personal Contract Purchase (PCP) and Hire Purchase (HP), is found to be the most popular choice among car buyers.

But, which type of car finance—PCP or HP—is better for you? Both PCP and HP offer unique benefits, and while they share similarities, there are enough differences that it’s essential to understand what each option offers.

To help you decide, we’ve summarised the key differences between PCP and HP. You can also check out our dedicated pages for a more in-depth look at each finance type.

Personal Contract Purchase vs Hire Purchase – Monthly Payments

When comparing PCP v HP finance, the monthly payments are one of the most significant differences. For both PCP and HP, you typically pay a deposit upfront (a cash sum and/or part exchange). However, if you finance the same car over the same period with the same deposit, the monthly payment will be noticeably different between PCP and HP.

With HP, you’re paying for the entire value of the car over the agreement period, meaning your monthly payments will be higher. In contrast, PCP payments are generally cheaper because a large portion of the car’s value is deferred to an optional final payment called the Guaranteed Minimum Future Value (GMFV). This balloon payment is paid at the end if you decide to own the car. Because of this deferred payment, many people choose PCP over HP for the lower monthly costs during the agreement.

PCP vs HP Finance – Limitations

When weighing PCP vs HP car finance, it’s crucial to understand their limitations. PCP finance comes with some potential drawbacks. The first and most significant is the mileage limit set at the start of the contract. If you exceed this limit, you’ll incur excess mileage charges. This limit is vital because it affects the GMFV; the more miles the car has, the lower the GMFV, which increases the gap between the car’s value and the GMFV, potentially raising your monthly payments.

Moreover, you need to be mindful of the car’s condition during a PCP agreement. Any damage to the vehicle could incur additional costs at the end of the contract. On the other hand, with HP finance and their lenders, such factors are less of a concern since you are making payments to own the car outright, and there are no mileage restrictions or condition assessments when the contract ends.

End of contract: PCP vs HP Finance – Which Is Best for You?

If you prefer a straightforward finance agreement, HP might be the better option, even though it may cost more monthly. With HP finance, you pay monthly until the car is fully paid off and becomes yours—simple as that.

However, with PCP finance, you have more flexibility at the end of the contract. When your PCP agreement ends, you have three options:

1. Return the car – Hand the car back to the lender and walk away without paying the GMFV.

2. Pay the GMFV – Make the optional final payment (or refinance it) to take ownership of the car.

3. Part-exchange – Use any equity built up in the car to part-exchange it for a new vehicle.

These options are why many consider PCP finance vs HP when deciding which is better for them.

Examples of PCP and HP Agreements

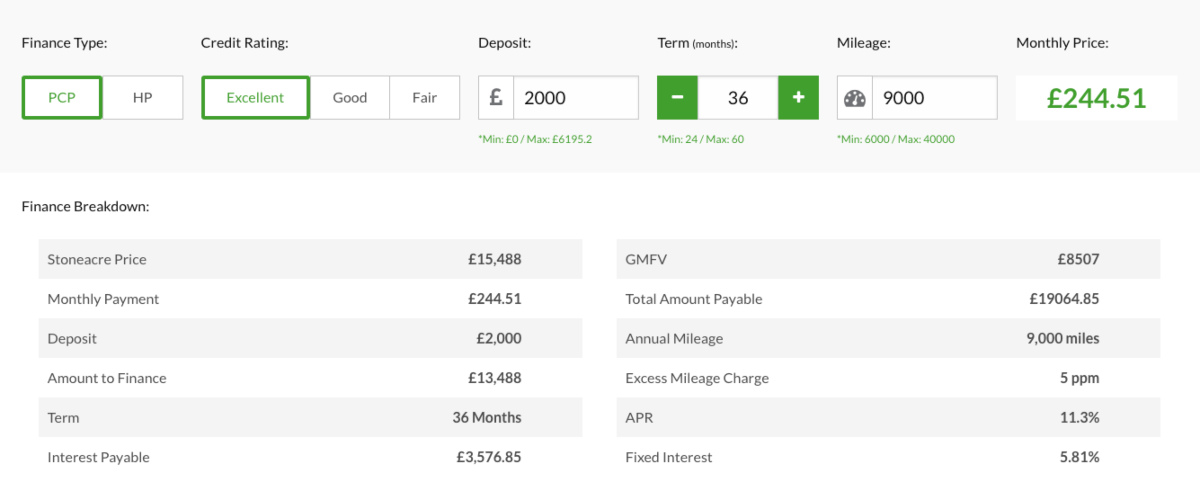

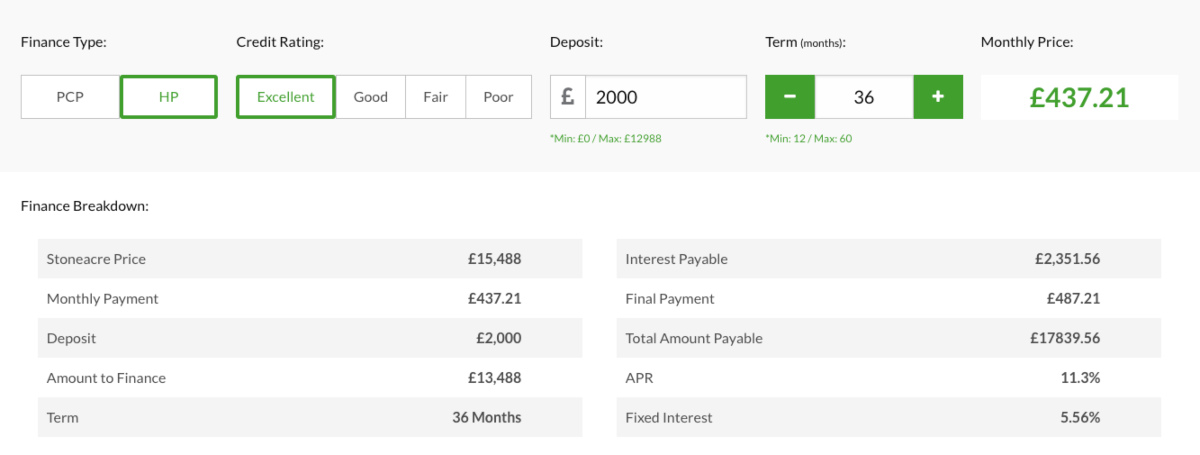

To see the differences between PCP and HP car finance agreements more clearly, here are two examples illustrating each type. Comparing the examples can help you better understand the cost implications and decide whether PCP or HP finance suits your needs better.

PCP (Ford Fiesta ST-Line – £2,000 Deposit/36-Month Term/9,000 mile PA)

HP (Ford Fiesta ST-Line – £2,000 Deposit/36-Month Term)

PCP vs HP FAQ

Is PCP or HP Better?

Whether PCP or HP is better depends on your individual circumstances and preferences. PCP typically offers lower monthly payments but requires a final balloon payment at the end of the agreement. This can be advantageous if you plan to trade in the car or want to upgrade frequently.

HP, on the other hand, involves higher monthly payments but results in full ownership of the car at the end of the term. This might be a better option if you intend to keep the car for a long time or prefer outright ownership. It’s essential to carefully consider your financial situation, driving habits, and long-term goals before making a decision.

Is PCP finance better than buying a car?

It depends on whether you want more flexibility at the end of the contract or if buying a car right away is a priority. When purchasing a car, you’ll need a large sum upfront which could take a large chunk out of your savings account, while with PCP, you will have fixed monthly payments but not own a car at the end, unless you pay a balloon payment.

What are the differences between PCP vs HP with balloon payment?

Personal Contract Purchase has an optional balloon payment at the end of the agreement, while Hire Purchase finance doesn’t have one. This is because, with HP finance, you’ll be paying for the full value of the car, while PCP monthly payments will be lower, but have a high balloon sum which is calculated using the car’s guaranteed minimum future value.

Should I choose PCP or HP finance to fund a used car?

At Stoneacre, we have a variety of used car finance deals to suit any needs. Used cars cost less than new, so Hire Purchase (HP) finance is a better way to fund a car than PCP, as you’ll be paying for the full value of a car and own it after the last monthly payment is made. It is also more common for dealers to offer HP finance rather PCP on used cars.

Representative example: £19,121.93 repayable over 48 months. 48 monthly payments of £323.72. Deposit of £1,266.23. Amount of credit £17,855.70. Representative 11.36% APR. Fixed rate per annum 6.46%. Final Payment £8,511.57. Option to purchase fee £399.00. Cost of Credit £6,194.43. Total amount payable (Incl. Deposit, charge for credit, final payment & purchase fee) is £25,715.36.