Ever wondered what your car insurance excess is and why it matters? It’s a common question among drivers. While it might seem like a small detail, understanding car insurance excess can significantly impact your out-of-pocket costs in case of an accident.

In this blog post, we’ll break down the concept of excess, how it’s calculated, and what factors can influence it. We’ll also explore some strategies to potentially lower your excess, saving you money in the long run.

Let’s dive in!

What is a car insurance excess?

In the event of an accident, you’ll need to pay the insurer a certain amount irrespective of which driver is at fault.

It is charged when you make a claim and the cost depends on a number of factors, such as the type of car you drive, how long you’ve been driving, age and others.

However, it’s possible to receive a refund on the insurance excess if the accident wasn’t your fault and the other driver has admitted responsibility. This depends on your insurance provider so make sure to read through the contract.

Compulsory and voluntary excess – how does it work?

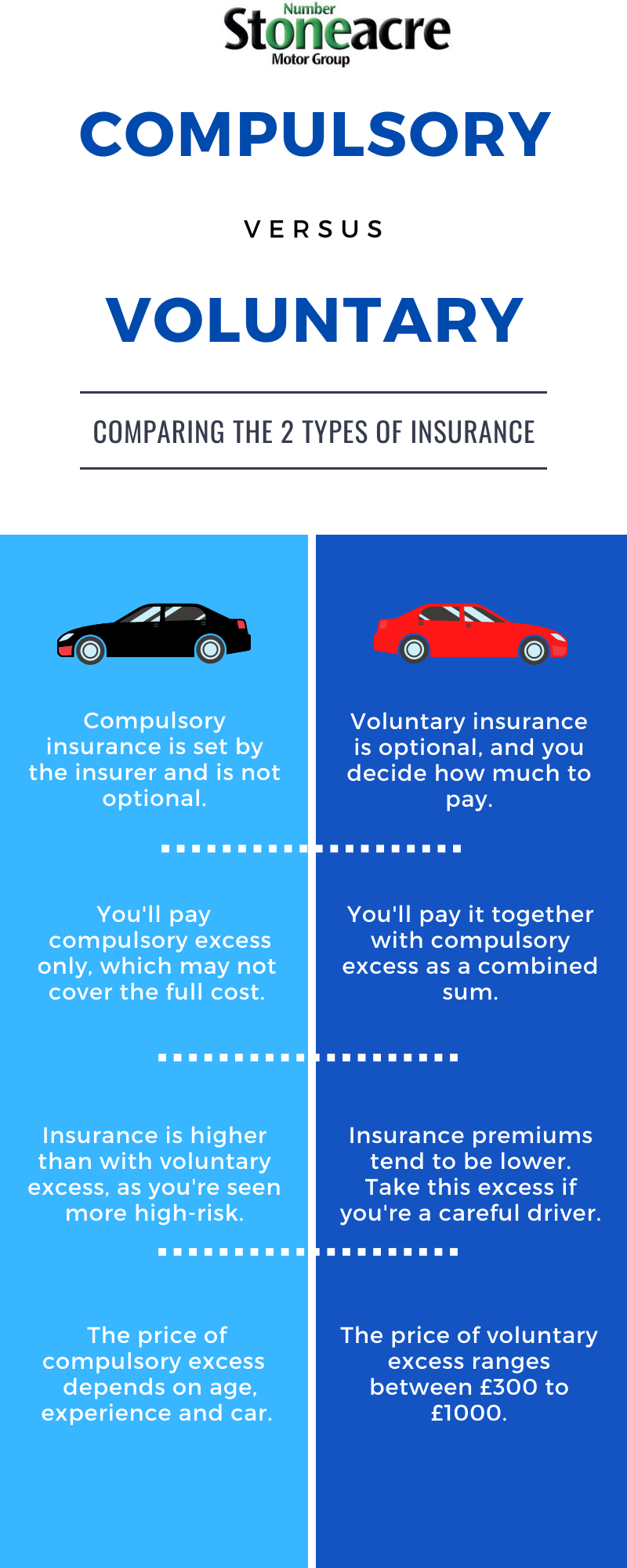

There are two types of car insurance – compulsory and voluntary.

Compulsory insurance is automatically applied to your policy and is set by the insurance company.

The excess can be drastically different for drivers who are older and have more experience compared to young people with little driving experience. If you drive a high-performance luxury or sports car, higher excess will also apply as these type of cars are deemed higher risk.

Meanwhile, voluntary insurance is the amount you contribute to pay on top of your compulsory insurance. If you contribute more toward voluntary excess, then the insurance gets lowered.

It’s worth shopping around when choosing the best insurance deal and take the price with voluntary insurance into account as it will be lower with a contribution. Just make sure you can afford to pay the excess if you’ll need to make a claim.

What if I can’t afford insurance excess?

This depends on the insurer if you can’t afford the excess they might refuse to process your claim. Other insurers could agree to a monthly instalment plan to make it more affordable for you.

How to pay insurance excess?

This is usually agreed between you and the insurer when you sign up for their insurance. You’ll need to pay when making an insurance claim.

What is an insurance excess waiver?

This is the type of insurance covers hire cars against paying excess insurance. If you have an insurance excess waiver, you won’t need to pay the excess in the event the car is stolen, been in an accident or written-off which can be costly if you don’t have this type of insurance.

How much excess to put on car insurance?

If you want to take out voluntary insurance, the usual insurance rates range from £300, all the way up to £1000. How much you want to put on car insurance depends on how confident you are that you won’t get into an accident. You can take out higher insurance excess if you believe yourself to be a careful driver. However, don’t forget that you will need to pay it in case of an accident or damage.