When it comes to financing a car, the options can feel overwhelming. With so many acronyms flying around—PCP, PCH, and Leasing—it’s easy to get confused. Each of these methods has its own benefits, pitfalls, and considerations that can greatly impact your finances and overall car ownership experience.

Whether you’re looking for flexibility, lower monthly payments, or long-term ownership, understanding these key financing options is essential.

In this blog, we’ll break down PCP (Personal Contract Purchase), PCH (Personal Contract Hire), and car leasing, exploring their differences and helping you determine which option best fits your lifestyle and financial goals.

What is PCP?

PCP (Personal Contract Purchase) is a popular car financing method that involves making regular monthly payments over a fixed term. At the end of the agreement, you have the option to either purchase the car outright at a pre-agreed price (the guaranteed future value or GFV) or return the car to the dealership.

If the car’s actual market value is less than the GFV, you’ll need to pay the difference. PCP is often attractive to those who want to drive a newer car without the long-term commitment of ownership. It can also be a good option for those who are unsure about their future driving needs.

What is PCH?

PCH (Personal Contract Hire) is a car financing agreement where you lease a vehicle for a fixed term and mileage. You pay a monthly rental fee, often including insurance and road tax. At the end of the agreement, you simply return the car to the leasing company.

PCH is a popular choice for those who want to drive a new car without the long-term commitment of ownership. It offers predictable monthly payments and the flexibility to change cars every few years. However, it’s important to be aware of excess mileage charges and potential wear and tear costs if the car is returned in poor condition.

What is Leasing?

Car leasing is a popular financing option that allows you to drive a new car for a fixed period without owning it outright. Instead, you pay a monthly lease payment to the leasing company. At the end of the lease term, you have the option to return the car or purchase it at a pre-determined price.

Leasing can be an attractive option for those who prefer to drive a newer model car every few years, as well as for businesses that need to regularly update their fleet.

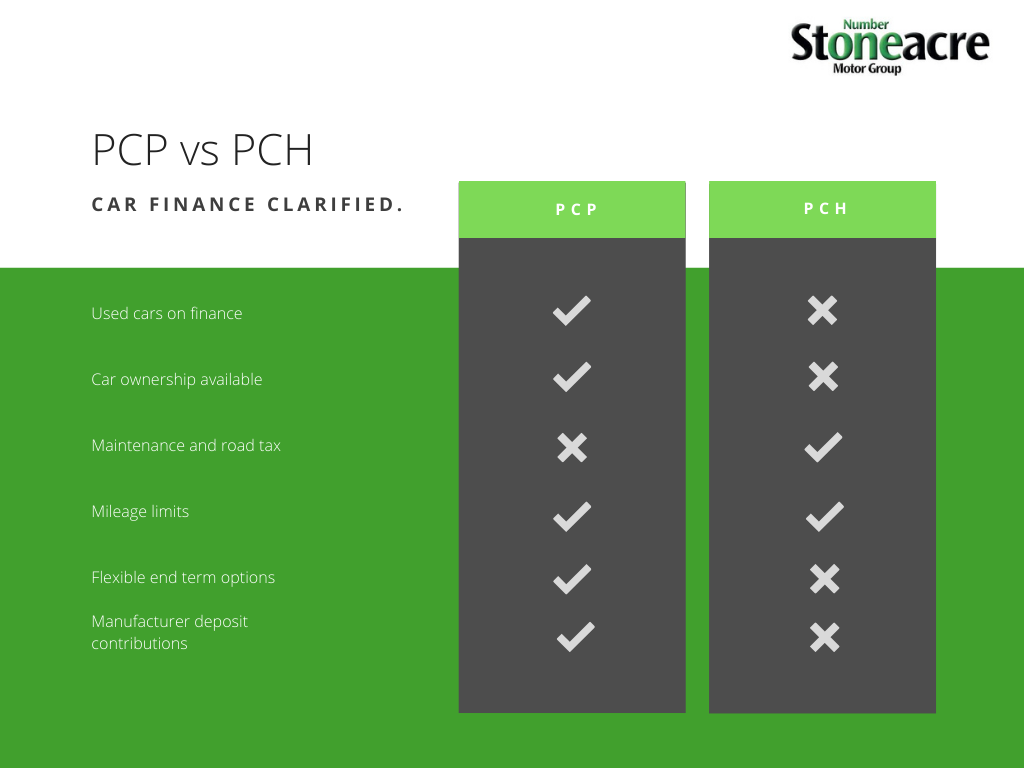

PCP vs PCH

PCP vs PCH are two popular car financing options. If you’re thinking about PCP, this finance option involves making monthly payments over an agreed period, followed by an optional final payment (balloon payment) to own the car. PCH, on the other hand, is a rental agreement where you pay monthly fees to use the car for a set term and then return it.

PCP Pros:

Lower monthly payments: PCP often has lower monthly payments than PCH due to the balloon payment.

Potential ownership: If you opt to pay the balloon payment, you can own the car at the end of the agreement.

PCP Cons:

Balloon payment risk: If you can’t afford the balloon payment, you’ll need to sell the car or refinance it.

Mileage restrictions: PCP often has strict mileage limits, and exceeding these can incur additional charges.

PCH Pros:

Flexible terms: PCH offers flexible terms, allowing you to choose a contract length and mileage that suits your needs.

No balloon payment: PCH doesn’t require a balloon payment, making it a more predictable option.

Maintenance and roadside assistance: PCH often includes maintenance and roadside assistance, reducing unexpected costs.

PCH Cons:

Higher monthly payments: PCH typically has higher monthly payments than PCP due to the rental nature of the agreement.

No ownership: You don’t own the car at the end of the PCH agreement

PCP vs Lease

So, what are the differences between PCP and Leasing?

End of Contract Options

One of the biggest differences between PCP and lease deals is that, with the former, you get a few options when it comes to the end of your contract – these include: handing the car back; using any equity in the car to part exchange for a new one; or paying the GMFV to take full ownership.

With leasing, it will be a simple case of handing the car back and walking away, or signing onto a new contract for a new car.

Age Of Car

While PCP and leasing can both be utilised for new car purchases, only PCP can be used additionally for acquiring a used vehicle.

Additional Packages

While you can get a separate service plan to go with your PCP deal, leasing deals can have maintenance packages built into the contract.

These packages can cover you for your annual servicing and also consumables such as tyres.

Interest Rates

What you pay during a PCP contact is largely affected by the interest rate(s) set against the purchase – the lower the rate the lower the overall cost; the higher the rate the higher the overall cost.

As such, there will likely be some differences in monthly payment costs between PCP and leasing deals on the same car because of this, as interest does not factor into the latter.

Deal Structure

There are some subtle differences when it comes to how a PCP deal is structured versus a lease package.

While both deal types typically require a deposit, this works slightly differently for a lease deal, as the deposit – or Initial Rental, as it’s labelled – is made up of so many monthly payments, and also makes up something known as the Profile.

A lease deal’s Initial Rental is typically three, six or nine lots of monthly payments combined, which is paid upfront as the first payment in the contact.

So, if the overall deal is 36-months long, and the Initial Rental is three monthly payments combined, then the Profile would be 3+35 (an Initial Rental made up of three monthly payments + 35 regular monthly payments to follow).

With a PCP deal, the deposit is a much simpler affair and is usually a certain percentage of the car’s value or you can put down an upfront amount that suits you.

Which is right for me?

Choosing the right car financing option between PCP, PCH, or leasing depends on your individual circumstances and preferences.

If you’re looking for lower monthly payments and the potential to own the car at the end of the agreement, PCP might be a good choice. However, be prepared for the risk of the balloon payment and potential mileage restrictions.

If you prefer flexibility, don’t want to worry about a balloon payment, and are okay with not owning the car at the end of the agreement, PCH could be a suitable option. PCH often includes maintenance and roadside assistance, providing added convenience.

Leasing is another option to consider, especially if you value short-term commitments and enjoy driving a new car every few years. Leasing typically includes maintenance and roadside assistance, but you’ll have to return the car at the end of the lease term.

Ultimately, the best choice for you will depend on your budget, driving habits, and long-term goals. It’s recommended to carefully compare the costs, benefits, and drawbacks of each option before making a decision.

Representative example: £19,121.93 repayable over 48 months. 48 monthly payments of £323.72. Deposit of £1,266.23. Amount of credit £17,855.70. Representative 11.36% APR. Fixed rate per annum 6.46%. Final Payment £8,511.57. Option to purchase fee £399.00. Cost of Credit £6,194.43. Total amount payable (Incl. Deposit, charge for credit, final payment & purchase fee) is £25,715.36.