Making sure you have a good credit score is extremely important when it comes to getting the best deals on car finance. However, you’re far from being alone if you don’t fully understand what your credit score is, what affects your credit score and how you can improve it.

We will be exploring the differences between a credit score and a credit check, see what can affect your score as well as cover some of the most frequently asked questions relating to credit. So if you’re already pretty savvy, you might want to scroll down to jump straight to the simple steps you can take to improve your rating, covered in our handy infographic.

Credit score vs credit check

Your credit score uses information on your credit report to predict how likely you are to pay back a loan. Having a good credit score shows that you have a tendency to make payments on time. This is important because when you apply for finance, a broker or lender will run a credit check to view your credit report. A credit check (also known as a credit search) is when a company looks at your credit report to assess your ability to afford credit. Your credit report is a file that records your history of managing and repaying debt.

Credit reference agencies are organisations that collect financial information about consumers. This information is used to create credit reports, which lenders use to make decisions about whether to approve loan applications. Credit scores are important, but they’re just one factor that lenders look at when considering a loan application.

There are two types of credit checks. A soft credit check is not visible to other companies. It will have no impact on your credit score and can be a helpful way for you to check your eligibility before completing an application. At Stoneacre, we offer a free finance eligibility checker so you can see if you’ll be approved before you apply.

On the other hand, a hard credit check will carry out a complete search of your credit report. Every check shows up on this, and many searches can harm your credit score as they can make you appear more desperate for money.

What affects credit score?

Lots of things can affect your credit score including;

- How much credit you have

- How long you have had credit for – never having any debt means you are a greater risk, as lenders have no history of you paying and managing debt

- How much you owe and how much of your available credit you are using known as your credit utilisation rate

- Your payment history – whether you have any missed payments

- Whether you are registered on the electoral roll

- How often you have applied for credit – lots of applications for credit in a short space of time can make you look desperate for a loan and this can have a negative impact

- The affordability of what you are asking for, taking into account what you earn and what you owe

- Being refused credit in the past

How to improve credit score?

While the list of factors which can affect your credit score above may seem daunting, the flip side is there are lots of things you can do to improve your credit score.

One of the first things you should do is check your credit report and make sure that the information held is accurate. If you notice any discrepancies, open credit that you no longer use or financial ties that are no longer valid, you should take appropriate action to get the information updated.

You should also check to make sure you are registered on the electoral roll, and if you aren’t, you should aim to do so as soon as possible.

Sometimes it is out of your control, but where possible you should try and show stability in your life by not frequently moving jobs or homes. Lenders are more likely to look favourably at borrowers who can prove they have a regular income and a stable home.

What if I have debts?

A low credit score could cause you to be denied for a loan or end up paying a higher interest rate. If you’re thinking about buying a car, it’s important to check your credit score beforehand. If your score is low, there are things you can do to improve it, like paying your bills on time and keeping your debt levels low. Improving your credit score takes time, but it’s worth doing if you want to save money on interest payments.

When it comes to any current debts, you should aim to manage them well making payments on time. With credit cards, you should try to pay more than the minimum amount monthly and if possible aim to keep your credit utilisation rate low. Sometimes it can work in your favour to spread credit card debt over a few cards to reduce your utilisation rate.

If you are looking to take new credit out, make sure you use soft credit checks to get an assessment of your eligibility before you apply. This way you won’t need to make lots of applications within a short space of time which can make you seem like you aren’t managing your finances well. Be realistic too, don’t apply if you know that your finances don’t add up, wait until you are in a better position and then proceed with an application.

Avoid taking out a payday loan at all costs. Not only will you get charged an extortionate amount of interest on this kind of loan, but they can severely impact your credit score as they make you look less reliable and not in control of your finances.

Don’t forget that debt can be a positive thing as if you have no lending history whatsoever, you can appear riskier to lenders, the key is demonstrating that you can manage your debts. In this case, the best place to start building your credit score up is by applying for a credit card but only using it for routine expenses like fuel and paying it off in full every month.

Credit FAQ

What is a good credit score?

The truth is there is no set credit score which is classed as good because the UK’s three main credit referencing agencies (CRAs) score consumers differently.

For general reference though, with Experian, a good score starts at 700, Equifax class a good score as 660 or above and finally Noddle’s best indicator is a 3+ on its 1-5 rating.

How can I raise my credit score in 30 days?

Improving your credit score can take time, but if you are looking to raise your credit score in a short period, the below steps may result in a quick boost:

- Correct any errors on your report – focus your attention on creditors who may be inaccurately showing you as having late or missed payments. It’s a good idea to phone and write to creditors to make them aware of the issue to spur them into action.

- Negotiate with your creditors – if you have got into default with your payments, you can contact the lender and see if they will accept a partial payment to clear the debt and reclassify it as paid on your report.

- Raise your available credit – while this may seem counter-intuitive by increasing your available credit, you can decrease your utilisation rate quickly, which can make you appear in a better position. This method can work well on credit card debt, so if possible, spread your debt evenly between cards rather than having one card maxed out.

How to build credit?

So if you’ve never had any debt, how do you go about building your credit score? One of the best ways to start building your credit history is by applying for a credit card. You needn’t worry about the credit card limit at this stage as you are aiming to build up a history of good debt management.

The best way to do this is to use the credit card to pay for something you would spend money on regularly, for example, fuel for your car or your weekly groceries. You should then pay the card off in full at the end of every month.

Getting a credit card is a good way to build up your credit quickly. However, you need to be careful that you only use the credit card for items you would usually purchase.

You also need to make sure you pay your bill on time each month. Fortunately, many lenders will give you the option of setting up a monthly direct debit to pay your card off in full, which can be helpful if you are likely to forget to make the payment otherwise.

Is it better to cancel unused credit cards or keep them?

We’ve already mentioned about credit utilisation rate and how spreading your debt over several cards can sometimes be better than having one credit card with all the debt, but what about credit cards you’re no longer using?

Generally, it is best to leave unused credit open. Doing so enables you to benefit from longer average credit history and more available credit. This strategy plays into credit scoring models which reward you for having long-standing credit and low rates of utilisation and is particularly beneficial if you plan to apply for a big loan soon such as a mortgage or a car loan.

However, there are certain circumstances when it is best to close the account. For example, closing an unused credit card may be for the best if it is a relatively new line of credit, if you are worried about being tempted to spend on it or if you are paying an annual fee on the card.

Can I still get car finance with a large deposit but a low credit score?

A person with a low credit score may still be able to get car finance if they’re willing to make a large deposit. The deposit will reduce the amount of money the lender needs to finance, and it shows that you’re serious about making your payments. You’ll probably still pay a higher interest rate than someone with a good credit score, but it may be possible to get approved.

If you have bad credit and are looking for car finance, it’s important to shop around and compare deals from different lenders. Be sure to read the fine print so you understand the terms of the loan, and don’t be afraid to negotiate. With a little work, you may be able to find a lender who’s willing to give you the

Can car finance improve your credit score?

Car finance can help improve a customer’s credit score in a few ways. First, by making timely payments, the customer will demonstrate their ability to handle credit responsibly. Additionally, car finance can help improve a customer’s credit mix, which is the variety of types of credit they have (such as instalment loans, revolving loans, etc.).

A good mix is considered helpful by Credit Reference Agencies because it shows that the customer can handle different types of credit responsibly. Finally, car finance can help reduce a customer’s overall debt-to-income ratio, which is another factor Credit Reference Agencies take into consideration when calculating credit scores. By reducing their debt load, the customer becomes less of a risk and may see an improvement in their credit score

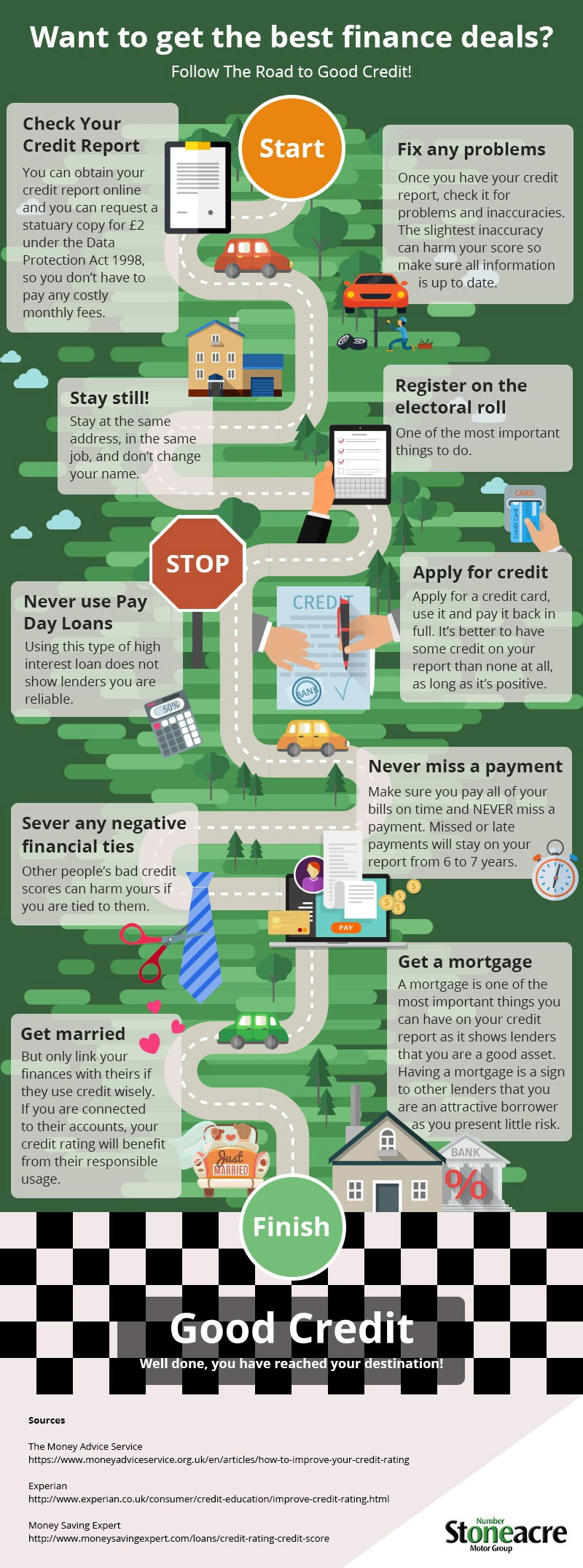

Road to good credit infographic

The below infographic demonstrates some simple steps you can take to boost your credit rating and is a great place to start if you are looking to build or improve your credit rating.

Representative example: £19,121.93 repayable over 48 months. 48 monthly payments of £323.72. Deposit of £1,266.23. Amount of credit £17,855.70. Representative 11.36% APR. Fixed rate per annum 6.46%. Final Payment £8,511.57. Option to purchase fee £399.00. Cost of Credit £6,194.43. Total amount payable (Incl. Deposit, charge for credit, final payment & purchase fee) is £25,715.36.